Start Your Free 14-Day Test Without Obligation!

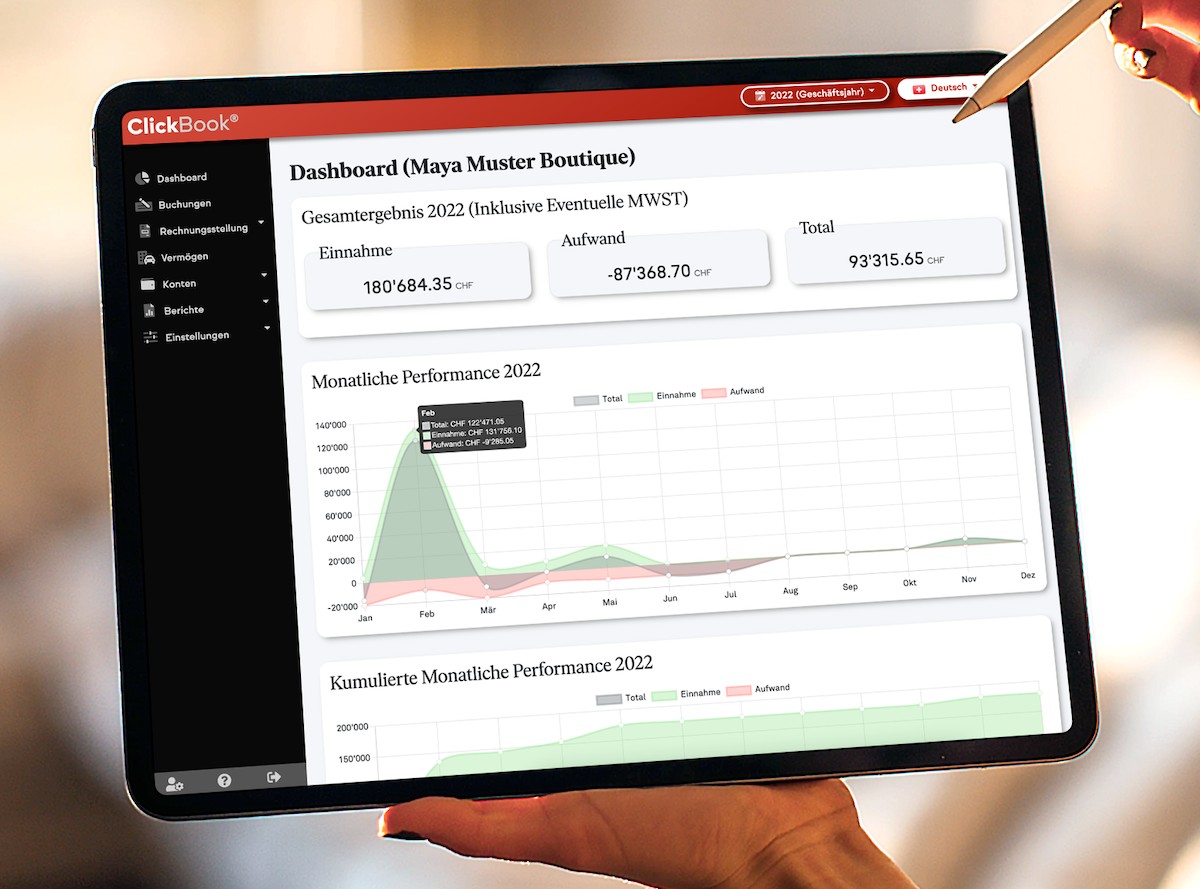

The only web-based Swiss accounting software with full functionality for self-employed.

Welcome to the ClickBook® course program. We are happy to show you in our webinars free of charge how you can use ClickBook® optimally for your sole proprietorship. An experienced fiduciary expert will lead the course and explain the use of ClickBook® with practical examples. You will also have the opportunity to ask individual questions!

We will be happy to show you the basis of accounting with ClickBook®, so that you can independently carry out your administration.

Course Outline:

The topic "VAT" is not always easy to manage for many companies. We show you with ClickBook® how you can optimally create your VAT statement in ClickBook® and submit it online to the Federal Tax Administration.

Course Outline:

For the tax declaration, a financial statement is necessary for all owners of a sole proprietorship. Together we will look at how you can do this using an example.

Course Outline:

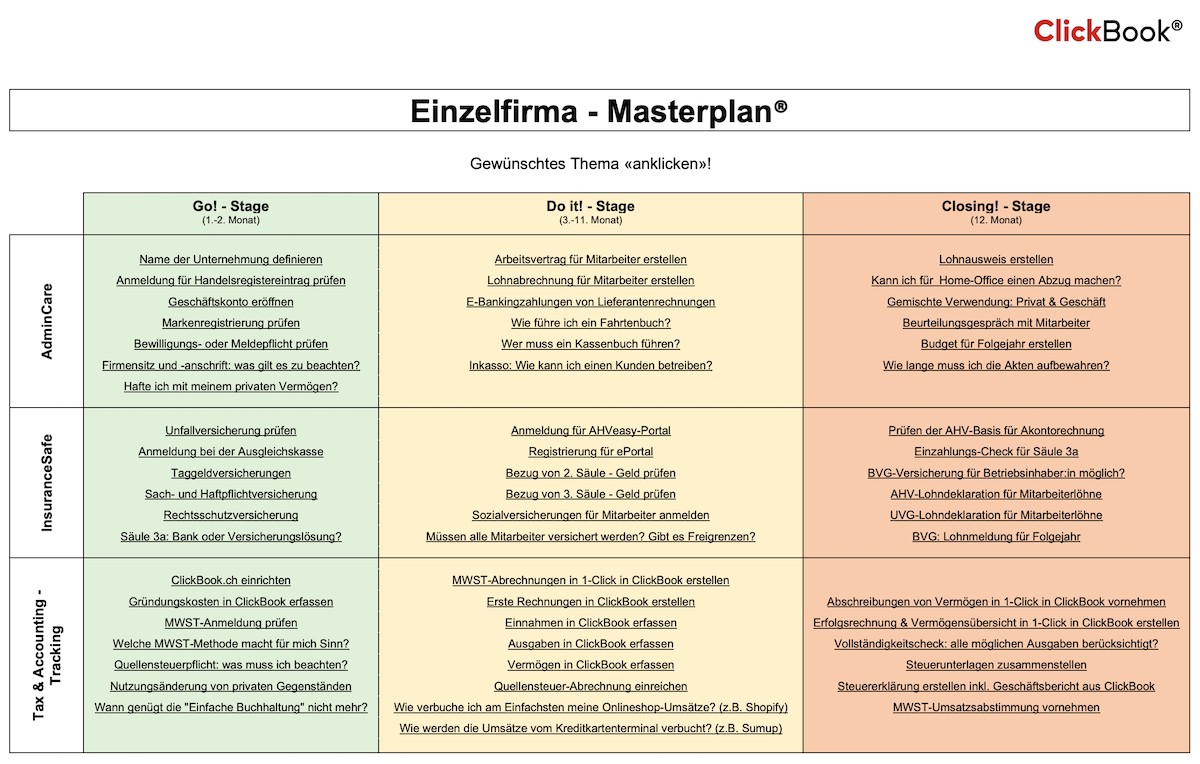

In our 3-part master plan we show owners of a sole proprietorship what they have to consider at the "start", during the "business year" and at the "annual closing". These tasks are divided into "AdminCare", "InsuranceSafe" and "Tax & Accounting - Tracking". The topics have been carefully compiled by an experienced fiduciary expert and are all practice-oriented.

As a ClickBook® subscription, the master plan is available to you at any time in the form of an e-book and explanatory videos in the ClickBook® application. If you have individual questions, you are also welcome to make an appointment with a ClickBook® fiduciary expert!

We are pleased to introduce you to the course instructor:

Dominik Tschochner will lead all courses. He is a federally certified fiduciary expert as well as a registered audit expert with 20 years of professional experience. In the last 20 years he has assisted many different small and medium sized companies in the areas of accounting, VAT, taxes, payroll, social security and company formation. In addition to his fiduciary knowledge, Dominik also has good technical knowledge in the IT field and is happy to assist "self-employed" people with their administration. Besides trusteeship, he also works as a coach for self-employed people for the canton of Zurich.

Why do we organize these courses?

We would like to show you during the courses how you can optimally use ClickBook® and not make any mistakes when posting the supporting documents, so that the bookkeeping with ClickBook® is 100% compliant with the law.

Why is there an Sole Proprietorship Master Plan®?

Often there are various issues that owners of a sole proprietorship need to be aware of at the start, during the current fiscal year and at the end of the year. Therefore, we have written this down in our unique, trademark-registered Sole Proprietorship Master Plan®, which is available in the form of an e-book for ClickBook® customers. The topics are practice-oriented and have been compiled over the past few years based on effective customer requests.